Trading at High Frequency High frequency trading, or HFT, is the use of highly complex computer algorithms to execute a massive number of transactions in the financial markets at high speeds. It employs advanced algorithms to monitor multiple markets and execute transactions as needed. In general, traders with the fastest execution abilities are more profitable than those with the slowest.

High-frequency trading is defined.

What is high-frequency trading

To automate trades, high-frequency traders use computer software and artificial intelligence (AI). This strategy employs algorithms to identify investment prospects. Large trading orders can be executed in a fraction of a second.

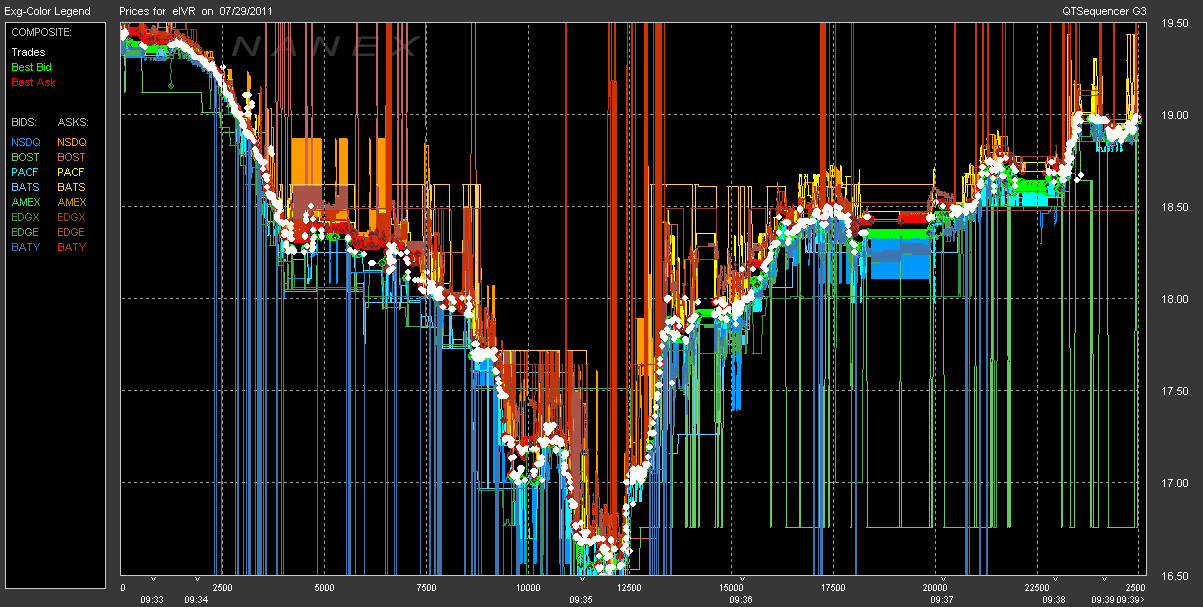

According to one study, when the government imposed fines on high-frequency trading, Canadian bid-ask spreads shifted (HFT). Bid-ask spreads increased by 13% across the market, while retail spreads increased by 9%.

The Securities and Exchange Commission (SEC) developed the following list of characteristics to standardise this type of trading:

- Orders are generated, routed, and executed using highly efficient software.

- To reduce networking and other delays, private information flows from exchanges and others may be used.

- Positions can be created and liquidated in hours, not days or weeks.

- Several orders are placed but are later cancelled.

- Trying to end the day with a viable flat position (that is, not carrying significant, unhedged positions overnight).

What are the advantages of using high-frequency trading?

Bid-ask spreads that were previously too low have been eliminated as a result of high-frequency trading. It was put to the test by increasing high-frequency trading (HFT) fees, which increased bid-ask spreads.

A high frequency trading example

High-frequency trading allows investors to capitalise on short-term stock market opportunities. Because they have early access to new opportunities, they may benefit before the market reacts.

For example, suppose a large investment firm decides to liquidate a portion of its holdings. This transaction involves approximately 1 million shares of Company X stock. In this case, the price per share of Company X is expected to fall temporarily as the market adjusts to the new stock offerings. This drop could last for minutes or even seconds, allowing an algorithm to execute several transactions while most human traders are distracted.

Conclusion -There are ups and downs to high-frequency trading.

High-frequency trading, proponents argue, helps markets quickly find stable, efficient values. Retail investors, according to these proponents, lack the time and resources to capitalise on these opportunities.

On the other hand, high-frequency trading is regarded as a market distortion. Because institutional investors can execute trade orders at a faster rate, they can influence the market to respond to transactions centred on algorithmic trading methods rather than market prices.